As a business owner, your employees are your most prized asset. Ensuring they’re adequately rewarded for their hard work and commitment is essential. But understanding the complexities of overtime pay laws and calculations can be challenging – failure to pay correctly can lead to costly legal issues, fines, and even lawsuits.

This article will give you everything you need about overtime pay: calculating time-and-a-half to understanding the legal requirements. Whether you have hourly or salaried staff, by the end of it all, you’ll have an accurate grasp on how payroll should be done – compliantly and fairly – so that everyone is rewarded for their effort. Not only will this help you avoid legal issues, but it’ll also build a loyal and motivated workforce.

We’ll discuss the following topics:

- What is Overtime Pay

- Understanding Overtime Pay Laws: Is It Illegal Not to Pay Overtime?

- How to Calculate Overtime Pay?

- How Time and a Half Works for Flexible Schedules

- Calculating Overtime Pay for Salaried Employees

- Record-keeping Requirements for Overtime Pay Calculation

- Wrap-up: Automate Your Payroll System for Streamlined Overtime Pay Calculation

What is Overtime Pay?

Overtime (OT) pay is the hourly wage that employers owe to employees who work over 40 hours in a workweek. Specifically, if an employee who gets paid by the hour works more than 40 hours in a week, by law their employer must pay them time and a half for the additional hours, or 1.5 times their hourly wage.

The good news is, if you need to pay your employees overtime, that means there’s no lack of demand for your company’s services. What’s more, no matter the size of your business, you can use tools that make it easy to calculate and pay employees for the overtime they accrue.

Understanding Overtime Pay Laws: Is It Illegal Not to Pay Overtime?

You may be wondering if it is illegal not to pay overtime. The answer is yes. The Fair Labor Standards Act (FLSA) establishes the federal overtime pay standards employers must follow, and it’s illegal for employers not to pay employees for their overtime hours or to try and evade paying them by misclassifying their job roles.

The FLSA requires that all non-exempt workers receive time-and-a-half wages for any hours worked over 40 in a workweek. Some states may also have additional laws requiring double time instead of just time-and-a-half for particular industries or hours per week worked.

It’s also important to note that certain exemptions apply under FLSA – specifically, managerial, executive, or professional employees may not be entitled to overtime wages if they meet certain criteria set by their employer.

State Overtime Laws

Additionally, some states have overtime laws, which may be more strict than federal law. For example, some states, such as California, have set daily overtime standards to ensure that nonexempt employees are justly rewarded for their hard work beyond the usual eight-hour shift. This means they may still be entitled to time-and-a-half pay even if they don’t clock 40 hours a week.

On the other hand, states like Colorado may demand up to 12 hours of labor before overtime is due. Of course, there are exceptions: firefighters and police officers are generally exempt from these regulations; public agency workers and those employed by hospitals or nursing homes also typically do not qualify for overtime pay.

It’s worth noting that employers are not obligated to provide extra compensation for the weekend or nighttime hours unless the total hours worked in a week surpass 40.

How to Calculate Overtime Pay?

The overtime pay calculation is simple: for a given week, track the amount of time your employee worked. Find out how many hours they worked over 40. Then, multiply their pay rate by 1.5 (time and a half). Finally, multiply this time-and-a-half pay rate by the number of overtime hours they worked. This will give you the amount you owe them for overtime.

The formula for overtime pay looks like this:

- Hourly rate of pay (H) x overtime rate (1.5) = OT.

For example:

- If the employee worked 45 hours and their hourly wage is $18:

- $18 multiplied by 1.5 equals $27;

- Multiply $27 by 5 (the number of overtime hours), which equals $135 — the amount you owe them for overtime.

- Multiply $18 by 40, which equals $720 — the amount you owe them for the standard workweek.

- Add $720 and $135, which equals $855 — the amount you owe them for all hours worked.

This is the basic math of overtime, but the reality is more complex. With remote work and flexible schedules becoming the new norm, you’ll need to know how to account for varying workweeks.

How Time and a Half Works for Flexible Schedules

When you’re calculating time-and-a-half overtime pay for employees with flexible schedules, the unit of time you want to look at is the seven-day workweek. So, if your business’s pay period is biweekly, break that down into weekly chunks. Hourly employees who work for more than 40 hours over a seven-day timespan must receive overtime.

When it comes down to it, the complexities of today’s work world mean you may have a variety of employees adhering to a variety of schedules. According to a survey from Upwork, 26.7% of employees worked remotely in 2021; by 2025, over 36 million Americans will be working remotely.

Since remote work and flexible schedules are more prevalent now than ever, you’ll need a scheduling solution that allows for a certain amount of flexibility. If there’s not enough work to justify overtime on any given week, use the scheduling software to limit the number of hours an employee can work that week. That way, they can work within their own parameters day to day, but they will not be able to exceed 40 hours in the week.

Flexible schedules work especially well for salaried employees who are focused on task completion instead of working a set number of hours. However, you may need to account for overtime with your salaried employees as well in your overtime pay calculator. By law, some salaried employees are exempt from receiving overtime, but others are not. How much the salaried employee makes is the determining factor. Read on to find out more.

Advantages of Having Workers with Flexible Schedules

Flexible schedules are widely popular with employees. Offering this type of schedule can help you attract and retain top talent while also increasing productivity and improving morale in the workplace.

Flexible schedules provide several other benefits as well:

- Employees can better balance their work-life commitments, such as childcare or caring for an aging parent.

- They have more control over their daily tasks and time management, which helps reduce stress levels for everyone involved.

- The organization can reduce its overhead costs by avoiding hiring additional staff members.

- Employees can be more productive since they have greater control over their work environment and are less likely to experience burnout.

- Organizations can better manage unexpected workloads or changes in demand without having to hire or fire people on a regular basis.

Drawbacks of a Flexible Workforce

While there are many advantages to having an employee with a flexible schedule, it can be difficult to manage. All employees must understand their hours and overtime pay requirements to comply with state and federal laws.

Managers must also be able to keep track of their staff’s working hours to ensure everyone is paid correctly. Additionally, organizations must take extra care when dealing with time-and-a-half overtime pay for salaried employees.

Business owners can utilize automated time trackers and payroll systems to ensure their time-and-a-half overtime pay calculations are accurate. With the right tools, managing a flexible workforce doesn’t have to be overwhelming or complicated.

Calculating Overtime Pay for Salaried Employees

You don’t normally need to track a salaried employee’s time and sum up their overtime hours because they’re exempt from the overtime-pay law. The Department of Labor’s (DOL) Fair Labor Standards Act (FLSA) specifies that certain salaried employees are exempt from the overtime pay requirements. To be exempt from overtime, the following employees must make at least $684 per week:

-

- Executives such as chief executive officer, chief operating officer, chief financial officer;

- Administrative employees such as managers;

- Professional employees such as teachers, lawyers, doctors, engineers;

- Computer employees such as engineers, programmers;

- Outside salespeople;

- Highly paid employees who make at least $107,432 per year.

The DOL set the $684-per-week salary requirement for these employees on January 1, 2020. Before that, salaried employees who were exempt from earning overtime pay had to make at least $455 per week.

It’s not hard to imagine a scenario in which an employer wasn’t able to raise their salaried employee’s pay rate to $684 per week. After all, the pandemic hit businesses hard. If any of your salaried employees still make less than $684 a week, you’ll need to track their overtime hours and compensate them accordingly.

Time and a Half for Salaried Workers

Here’s how to calculate a salaried employee’s overtime pay:

- Divide their weekly salary amount by 40 to calculate the applicable hourly rate;

- Multiply the hourly rate by 1.5 to find the OT rate;

- Multiply the OT rate by the amount of time they worked over 40 hours to find the total amount of OT pay you owe them;

- Add the total amount of OT pay to their weekly salary to calculate the total weekly paycheck.

For example:

- If they make $455 per week, $455 divided by 40 equals $11.37.

- Take this hourly rate of $11.37 and multiply it by 1.5, which equals $17.05 — the amount you owe them for OT.

- Multiply $17.05 by the number of overtime hours they worked; if they worked 43 hours, $17.05 multiplied by 3 equals $51.15.

- Add $51.15 to $455 to obtain $506.15 — the total amount you owe them for the 43-hour workweek.

Let’s examine a scenario in which you might need to pay a salaried worker overtime. You have a traveling sales rep who earns commissions for each sale they make, and commission can count as salary. But for whatever reason, the sales rep doesn’t meet the DOL’s requirements for exempt employees who earn a commission.

For the sales rep to be exempt from OT, commissions must account for more than half of what they earn per year (or month, pay period, week — this depends on the terms of their salary). If they don’t earn enough commissions, you’ll have to pay them overtime for those weeks when they worked for more than 40 hours.

Since this is a traveling sales rep, you’re faced with the question of how to know exactly how many hours they worked. The solution is to implement time tracking for all of your salaried professionals. Doing so will establish a culture of trust and transparency in your company. Your salaried salesperson or any others who are on salary will know that, if they work overtime and are not exempt from OT pay, they’ll get paid for it.

Record-keeping Overtime Pay Calculation

Overtime pay calculations can be complicated, and it’s important that you keep accurate records so you can ensure your employees are getting paid correctly. Start by tracking the total hours worked each week, as well as any overtime hours accrued. You should also track the employee’s regular pay rate and overtime hourly rate (time and a half).

If your company has multiple locations or shifts, make sure to list all of them in order to accurately calculate both standard and overtime pay for each location/shift combination. Additionally, if an employee works different jobs with different rates of pay during a single workweek, you must use their total earnings to calculate their overtime rate.

Alternatively, you can simply switch to an automated payroll system that does all the heavy lifting for you. Automated payroll systems are easy to set up and use, and they provide accurate calculations of OT pay in an instant.

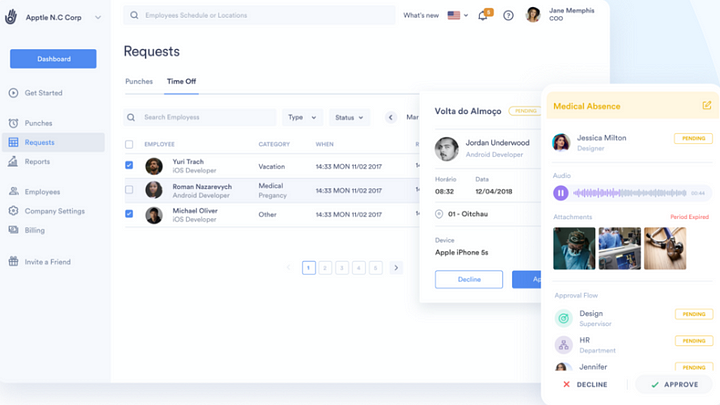

An automated payroll solution and overtime pay calculator like Day.io brings you the following benefits:

- Easy setup and use

- GPS and WiFi authentication for location tracking

- Accurate overtime pay calculator with time and a half for each employee

- Automated tracking of hours worked across locations/shifts

- Streamlined paychecks that include all relevant taxes, deductions, and overtime pay calculations.

- Project details with overtime tracking for accurate billing

- Cost and billing breakdowns for clients

- Paid time off calculator and vacation approval system.

Wrap-up: Automate Your Payroll System for Streamlined Overtime Pay Calculation

Overtime pay can be complicated if you don’t have the right tools in place to manage it. However, by automating your payroll system with a solution like Day.io, you can easily calculate and pay employees for their overtime work without hassle or guesswork.

With Day.io, you can calculate overtime pay quickly and accurately using our built-in time tracking feature. This eliminates the need to manually enter employee hours and ensures that your employees are always paid correctly. Plus, it makes record-keeping easier, so you can access past payroll information as needed in a few clicks.

Overtime pay is an important part of doing business, but it doesn’t have to be complicated or difficult to manage with the right tools in place. Automate your payroll system today for streamlined overtime pay calculations and accurate record-keeping!