As an independent contractor, you’re in the driver’s seat of your professional destiny – free to pursue projects that challenge and inspire you. But with this freedom comes great responsibility: managing taxes.

This guide is designed to serve as a roadmap for navigating the complexities of independent contractor taxation, from determining your status to understanding the unique forms you need to file and maximizing deductions. Whether you’ve been freelancing for years or are just starting your self-employed journey, we’ll show you how to stay compliant while making the most of your hard-earned income.

Dive into our comprehensive guide and gain the confidence to take control of your taxes and focus on what matters – growing your business and pursuing your passion.

Throughout this article, we’ll discuss:

- Determining Independent Contractor Status

- Who is an Independent Contractor?

- Tax Forms for Independent Contractors

- Federal and State Income Tax for Independent Contractors

- Tax Deductions for Independent Contractors

- Recordkeeping and Organization of Independent Contractor Taxes

- Tax Planning Strategies for Filing Independent Contractor Taxes

- How Does a Time Tracker Help You Manage Your Taxes?

- Wrap-up: Plan Ahead and Comply with Tax Regulations as an Independent Contractor

Determining Independent Contractor Status

The Internal Revenue Service (IRS) uses a set of guidelines known as the “common law rules” to determine if an individual is an independent contractor or an employee. These rules focus on three main factors: behavioral control, financial control, and the relationship between the worker and the payer.

- Behavioral Control: This refers to the payer’s ability to direct and control how a worker performs their tasks. Independent contractors typically have more freedom in deciding how to complete their work without being micromanaged by the payer.

- Financial Control: Independent contractors can generally affect their profits and losses, invest in their business, and negotiate payment terms. They may also work for multiple clients at the same time.

- Relationship: The relationship between the worker and the payer is also considered. Written contracts, employee benefits, and the relationship’s permanency can all influence a worker’s classification.

It is important to note that no single factor determines a worker’s classification; the IRS will consider the entire relationship and weigh each factor based on the specific circumstances.

Who is an Independent Contractor?

Based on the IRS guidelines, an independent contractor is someone who:

- Controls and directs the work they do

- Has the right to control their profits and losses

- Does not receive employee benefits from their payer

- Can be paid by multiple clients at once

- Works with a written contract that defines the relationship between them and their payer.

Let’s illustrate this with an example.

You are a freelance graphic designer. You have the freedom to work when and how you choose and can find clients through your network or online platforms such as Upwork or Fiverr. You negotiate payment terms with each client, invest in tools and resources to help you be more productive, and are not provided any employee benefits. In this case, you would likely qualify as an independent contractor for tax purposes.

In contrast, you work as a full-time nanny for one family, are paid hourly, and have no control over when or how you work. You receive benefits like vacation days and health insurance from your employer. Based on the above-stated common law rules, you would likely be classified as an employee for tax purposes.

Professionals who qualify as independent contractors include:

- Legal practitioners

- Dentists

- Accountants and bookkeepers

- Graphic designers

- Web developers and programmers

- Copywriters, editors, and translators

- Photographers and videographers.

Tax Forms for Independent Contractors

Independent contractors must use two primary tax forms: Form W-9 and Form 1099-NEC.

Form W-9

Form W-9 provides your name, address, taxpayer identification number (TIN), and other information to the payer who hired you. It also includes an important section that allows you to certify that you are an independent contractor or self-employed worker so they can correctly report your income on a Form 1099-NEC.

Form 1099-NEC

NEC stands for “nonemployee compensation,” and Form 1099-NEC is used to report the income you received for your services as an independent contractor. It shows how much money was paid to you, which can then be reported on your taxes.

Previously, Form 1099-MISC was used to report nonemployee compensation for independent contractors. In 2020, the IRS issued a new form – Form 1099-NEC – that replaced the old one.

Federal and State Income Tax for Independent Contractors

The most significant tax burden for independent contractors is the self-employment tax. This tax, which is paid to both the federal and state governments, covers Social Security and Medicare taxes. The current rate for self-employment taxes at the federal level is 15.3%. The breakdown is as follows:

- Social security: 12.4%

- Medicare: 2.9%

In addition to this tax, you also need to pay income taxes on your earnings from being an independent contractor. These are calculated based on your estimated annual income and filing status (single or joint).

Understanding the Tax Brackets

Navigating the tax landscape as an independent contractor can be complex, but understanding the 2022-23 tax brackets is crucial for effective tax planning.

For single filers, the marginal tax rates range from 10% on income up to $10,275, to 37% on income over $539,900. The brackets are adjusted for married couples filing jointly, with the same percentage rates applied to higher income thresholds.

Keep in mind that falling into a particular tax bracket based on your taxable income doesn’t mean you’ll pay that rate on your entire income. The U.S. utilizes a progressive income tax system, which means your income is taxed at various rates, and the marginal rate represents the highest rate applied to your earnings.

Understanding this distinction is essential for accurately estimating your tax obligations and making well-informed financial choices throughout the year.

At a state level, additional income tax requirements might exist depending on where you live. Some states also have self-employment taxes, so check with your state’s Department of Revenue for more information.

4 Tax Deductions for Independent Contractors

As an independent contractor, you are eligible for a variety of tax deductions that can help reduce your overall tax liability. The most popular deductions include the following:

1. Home office Deduction

If you use part of your home regularly and exclusively for business, you may be eligible for a home office deduction. This deduction covers the costs associated with maintaining, repairing, and renting/owning the space used for business purposes.

2. Business Expenses

In addition to the home office deduction, independent contractors can also deduct certain business expenses from their taxes. These include costs related to supplies, advertising, and marketing, travel expenses (including meals), as well as legal and professional fees.

3. Health Insurance Premiums

Self-employed individuals can deduct premiums paid for health insurance coverage on their tax returns. This includes both the premiums for yourself and your family members.

4. Retirement Plan Contributions

Finally, independent contractors can make tax-deductible contributions to their retirement accounts such as a SEP IRA or Solo 401K. This helps you build financial security while reducing your taxable income.

Recordkeeping and Organization of Independent Contractor Taxes

Once you’ve determined that you are an independent contractor, the next step is to ensure your records are organized and up-to-date. Here are some tips to ensure your documents are in order:

- Keep all invoices, receipts, and other financial records related to your business expenses.

- Be sure to log every income transaction you make and keep track of payments received.

- Document all business travel expenses, including mileage, tolls, lodging, and meals.

- Organize your electronic files into separate folders for each tax year so they’re easy to find when it comes time to file taxes.

- Use a time-tracking app to keep track of your hours worked, project details, and invoices sent.

Tax Planning Strategies for Filing Independent Contractor Taxes

Tax planning is an essential element of successful independent contractor tax filing. It’s essential to plan ahead and prepare for the inevitable taxes owed throughout the year, rather than waiting until the end of the year when you’re scrambling to make sense of your financial situation.

Here are some strategies that can help you stay organized and maximize deductions:

- Set aside a percentage of each payment you receive for taxes – this will ensure that you have enough funds come tax time.

- Take advantage of business expense deductions such as health insurance premiums, home office expenses, and travel costs.

- Contribute to a retirement account like an IRA or SEP to save on taxes and prepare for the future.

- Pay estimated quarterly taxes throughout the year rather than waiting until April 15th.

How Does a Time Tracker Help You Manage Your Taxes?

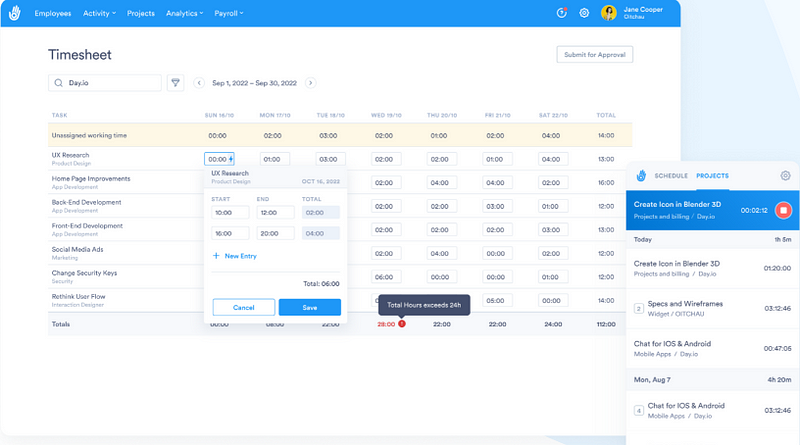

As an independent contractor, it’s important to track your time and expenses accurately in order to maximize deductions and ensure compliance with tax laws. A reliable time tracking solution like Day.io can help you manage your time and expenses with ease.

Day.io makes it easy to log the hours you work and any associated expenses such as travel costs or materials purchased for a job. You can even create invoices from timesheets directly from the app, making it easier to stay on top of your income and deductions come tax time.

Wrap-up: Plan Ahead and Comply with Tax Regulations as an Independent Contractor

Navigating the world of independent contractor taxes may seem daunting initially, but with the proper knowledge and resources, you can confidently meet tax requirements and maximize your deductions. Stay abreast of your tax obligations, keep accurate records, and seek professional advice when necessary to ensure you’re on track.

As you plan for financial success, leverage tools that simplify workflows and make tax compliance effortless. Sign up for Day.io today – a revolutionary freelance time-tracker designed specifically for independent contractors like yourself!